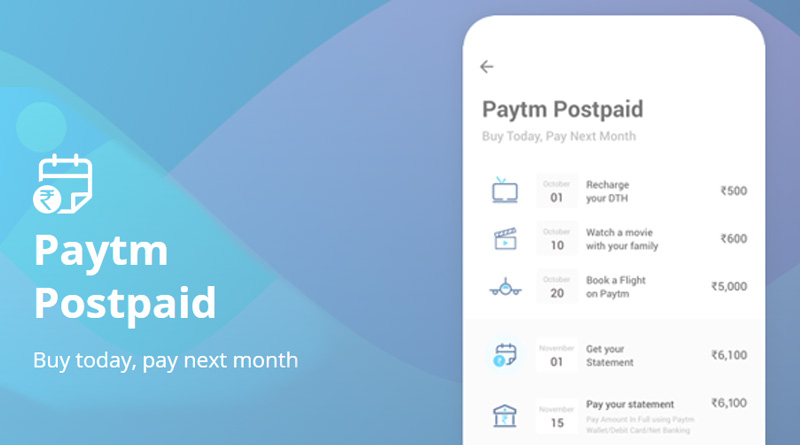

India’s leading mobile wallet company paytm has launch its pay later service named “PayTM postpaid”. In postpaid service user avail the service and pay it later, people have credit card know this very well. It allows users to buy today and pay the due in next month.

Who can apply for postpaid service? | Paytm Postpaid eligibility!

Their no eligibility criteria for users. Paytm postpaid service is available to KYC as well as Non KYC users. Paytm postpaid is very helpful specially when its last date of month, when money crunch it on peek.

How To Apply Paytm Postpaid?

Paytm is known for its simplicity they always enhance and make the experience easy to them. To activate postpaid service you don’t required any registration, just follow the below steps and get your postpaid.

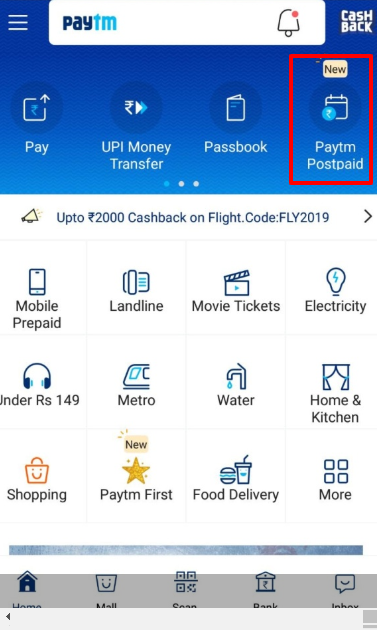

Step 1: Launch the paytm app and find the paytm postpaid option. Option will available at the top right corner of the app screen. Screenshot of app is attached below.

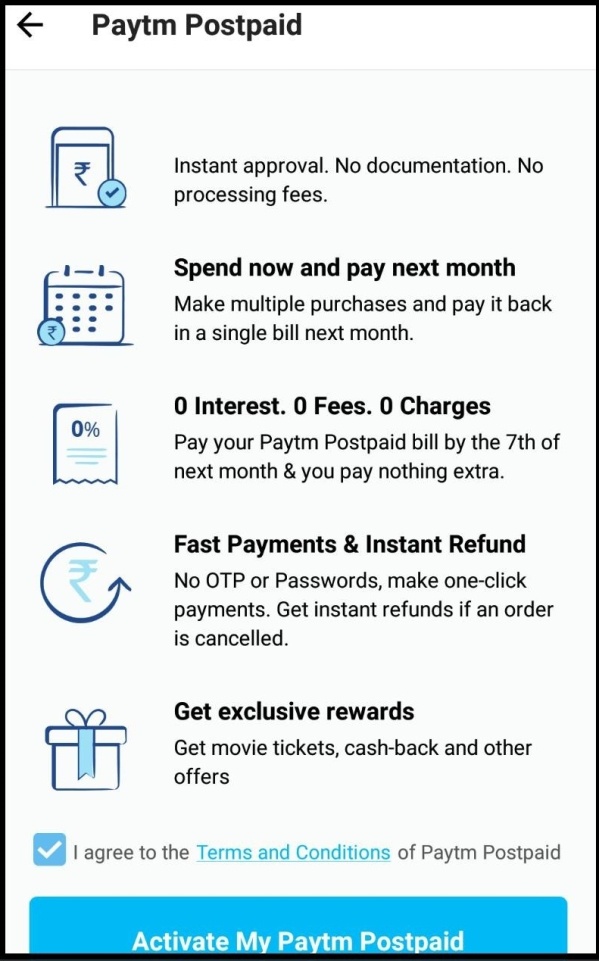

Step 2: Tap the paytm postpaid option, which leads you to postpaid terms and conditions page. Accept the terms and conditions to activate postpaid service.

After completing the step 2 screen will appear which activation message along with available spend limit. Screen shot attached below.

Benefits Of Paytm Postpaid

There are lots of benefits of using paytm postpaid few of them are mentioned below.

- Shop now and pay later.

- Free of cost to avail Paytm Postpaid services.

- No interest on the amount for some duration.

- A fast and higher success rate of the transaction.

- No documents required to activate Paytm postpaid.

- You can recharge or shop from paytm Postpaid balance.

- You don’t need to enter your card details or UPI Pin for making payments from Paytm Postpaid.

Charges Of Paytm Postpaid | Free credit period of paytm postpaid

Paytm is not charging anything from their user for their postpaid service. They are providing 35 day of credit in their postpaid service. Learn how paytm is better than credit card.

Paytm postpaid charges and interest | paytm postpaid late charges

Paytm will generate the due bill on 1st of every month which user have to pay by 7th of the month. Paytm will not charge any amount if you clear your bill by due date. If any case you miss the bill payment, you will be charge for according to below table.

Late payment charges slab:

| Due Amount | Late Fee/Month |

| Upto ₹50 | ₹5 |

| ₹51-100 | ₹10 |

| ₹101-500 | ₹50 |

| ₹501-1000 | ₹100 |

| ₹1001-2000 | ₹200 |

| ₹2001-5000 | ₹500 |

| Above ₹5000 | ₹600 |