Most awaited PayTM’s payment bank has launched for everyone. Know how to open your account in paytm payment bank. But unlike other payment bank it will not offer you 7% interest. PayTM currently offer only 4% interest per anum. Here we will let you know other features of PayTM payment bank.

PayTM vs Other Payment Banks

Other companies like Airtel, fino are also have their payment bank’s. Now question is which payment bank I should use. My personal suggestion is to use PayTM payment bank.

Being a payment bank all bank have limitation like maximum cap of money deposit is 1 Lakh. Inspite of this paytm bank have special feature which make it special from other.

Reach to potential customers

Since paytm is india’s largest digital wallet company. It has wide range of product and range of stores where you can use them.

Virtual Debit Card

PayTM payment bank linked your saving account to a virtual RuPay debit card which can used for e-commerce transactions. It make possible to use your payment bank where paytm is not available as payment option.

Other payment bank companies like Airtel doesn’t provide this facility to their customers, therefore you cann’t use Airtel payment bank where airtel money is not a option as payment option.

Transaction Charges

Unlike other payment bank like airtel, paytm payment doesn’t charge anything as transaction fees. You can transfer fund using IMPS service 24X7 to any bank without any charges where airtel took 0.5% depends on amount you are transferring.

No limit of keep cash into PayTM Payment Bank

According to RBI guidelines about payment banks. Payment banks cannot accept more than 1 lakh deposit, but PayTM payment bank

has overcome this feature using its Fixed Deposit account.

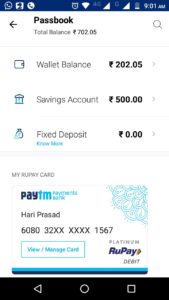

When you open your bank account detail option in paytm app your will find three option there refer the screen shot below.

1) Wallet Balance: It shows the balance you have in your paytm online wallet.

2) Saving Accoutn: it shows the balance you have in your paytm payment saving account

3) Fixed Deposit: Any time if your saving account exceed from 1 lakh, paytm will transfer automatically transfer amount exceed from 1 lakh to fixed deposit which will give you the interest of 6.5% per anum.

PayTM will not charge anything for creation of fixed deposit or withdraw amount from fixed deposit. So virtually there is no limit to keep money into paytm payment bank